how are annuities taxed to beneficiaries

When you make withdrawals or begin taking regular payments from the annuity that money will be taxed as ordinary income. Also if the annuitant and owner are different beneficiaries younger than 59 12 are subject to an extra 10-percent tax penalty on paid-out earnings.

Compare Annuity Rates Annuity Lifetime Income Investment Advice

Any growth or earnings inside of an annuity are tax-deferred until you start receiving income from the annuity.

. Annuities are often complex retirement investment products. However that doesnt mean youre completely off the hook. How Are Annuities Taxed.

This means the money was already taxed before it was put into the annuity. Annuities are tax deferred. Ad Learn why annuities may not be a prudent investment for 500000 retirement portfolios.

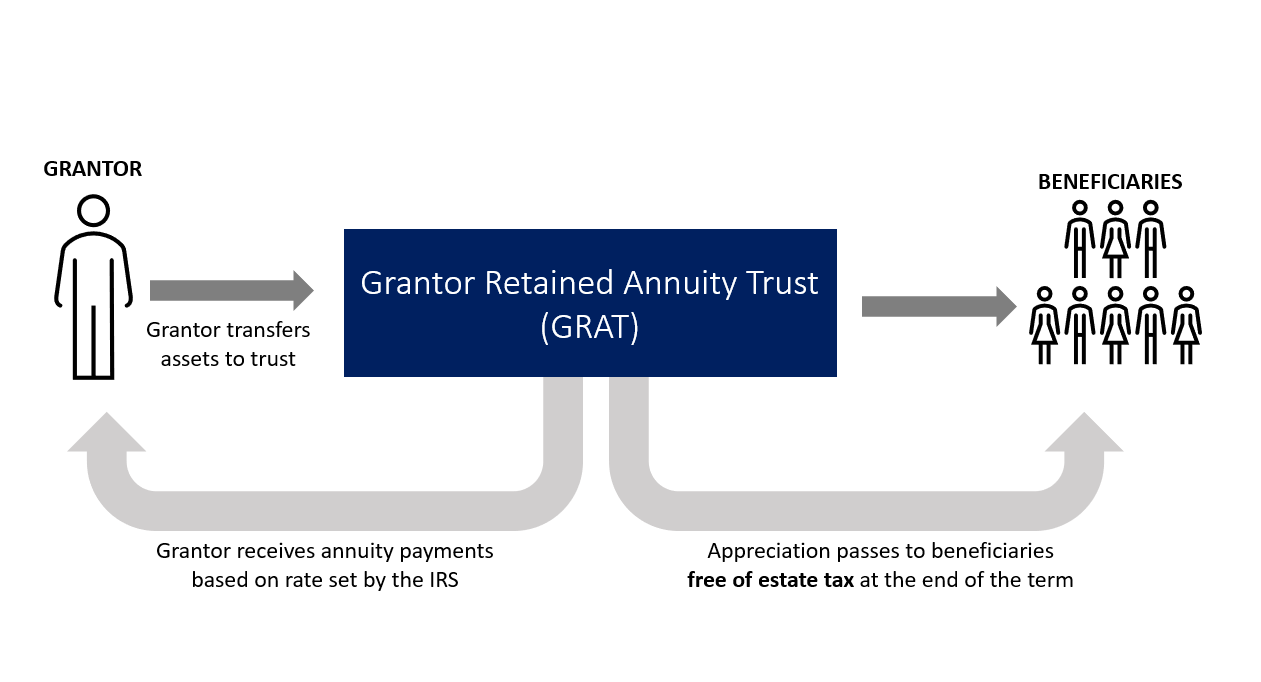

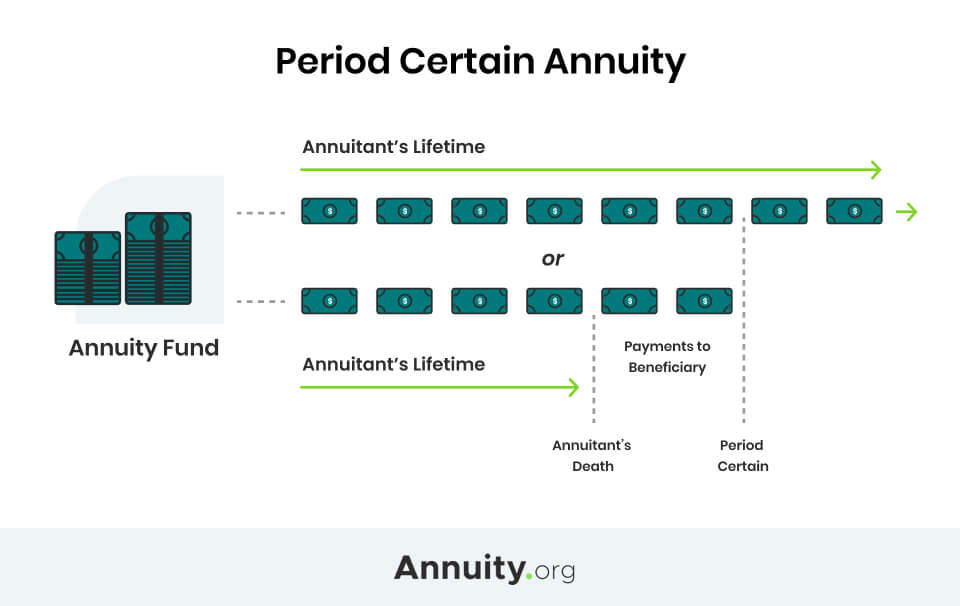

The taxed amount depends on the payout structure and the beneficiarys relationship with the annuity owner as a surviving spouse or otherwise. Any money you take out before age 59½ will also. Beneficiaries of Period-Certain Life Annuities.

Inherited Non-Qualified Annuity Taxes. How Annuities Are Taxed. Learn some startling facts.

How Inherited Annuities Are Taxed. Ad Learn More about How Annuities Work from Fidelity. What this means is taxes are not due until you receive income payments from your annuity.

Rather taxes arent due. The IRS treats distributions paid to an annuitant from qualified. Depending on the payout structure as well as the beneficiarys relationship to the annuity owner the taxed.

If you have an annuity contract you can choose a beneficiary to receive the remaining payments or lump sum death benefit if you die. With non-qualified annuities funds come from post-tax dollars. If the annuity passes to the beneficiaries.

But that doesnt mean theyre a way to avoid taxes completely. Benefits paid to a survivor under a joint and. Ad Learn More about How Annuities Work from Fidelity.

The beneficiary must figure the tax-free part of each payment using the method that applies as if he or she were the employee. Inherited annuities are taxable as income. In particular most annuities have a death benefit and understanding how that death benefit will get taxed to the beneficiary who receives it is an important part of deciding.

Yes any earnings from inherited annuities are subject to taxation. Your beneficiaries have a few options for dealing with the inherited annuity -- and the tax bill it triggers. Some annuities are period-certain annuities which combine the benefits of a fixed annuity and life annuity by guaranteeing both.

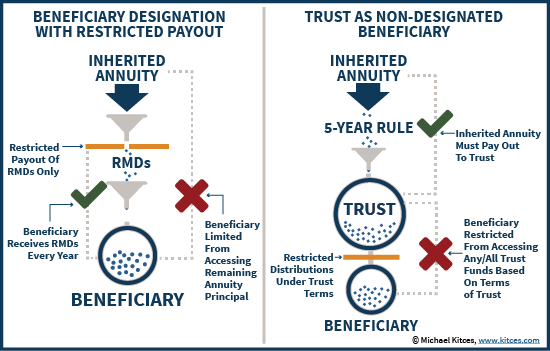

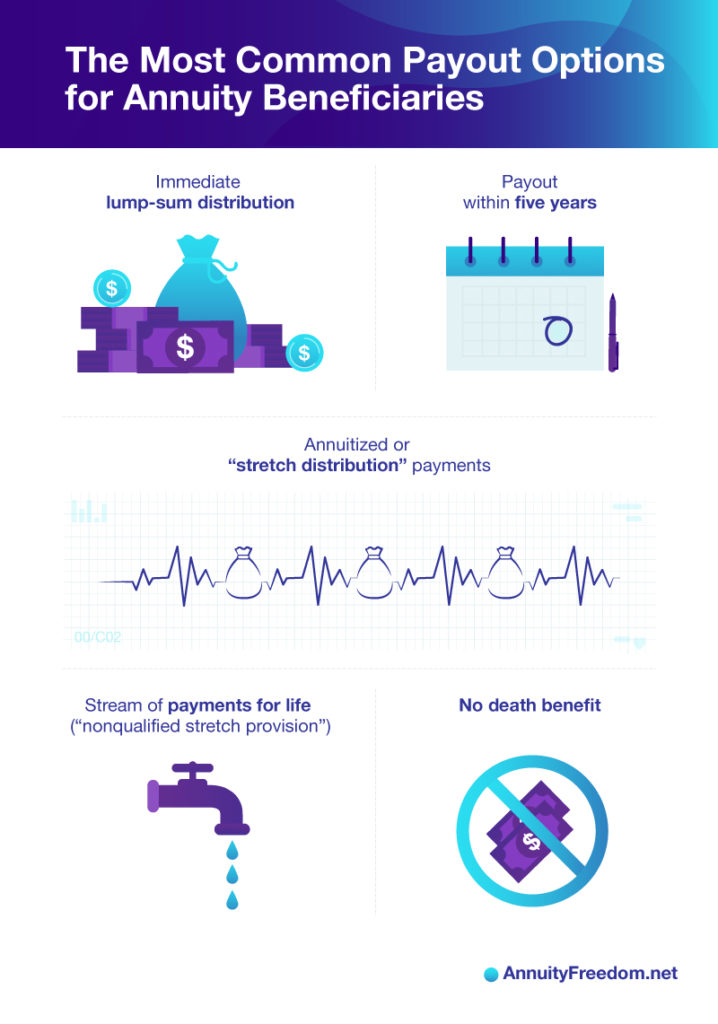

But taxation on contributions and. The way that any given annuity is taxed depends on the money used to set it up. The beneficiary of a tax-deferred annuity may choose from several payout options which will determine how the income benefit will be taxed.

How it is taxed. Understanding how inherited annuities are taxed starts with knowing the difference between qualified and non-qualified annuities. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying.

If you used pre-tax dollars to fund your initial deposit its a qualified annuity. An annuity is qualified if you purchase it with pre-tax dollars via a tax-advantaged account such as an IRA or 401k. The simplest option is to take the entire amount as a lump sum.

However an inherited annuity is taxable. One of the most defining features of annuities are that theyre tax-deferred.

Annuity Beneficiaries Inheriting An Annuity After Death

Inherited Annuity Tax Guide For Beneficiaries

Trust Vs Restricted Payout As Annuity Beneficiary

Difference Between Annuitant And Beneficiary Difference Between

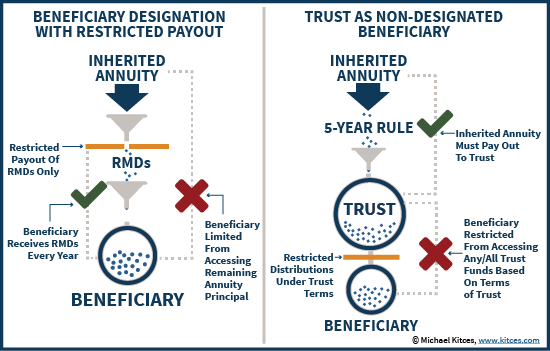

How To Use Grantor Retained Annuity Trusts Grats To Transfer Wealth To Beneficiaries Tax Free Plancorp

Abney Associates Ameriprise Financial Advisor In Melville Ny Ameriprise Financial Financial News Changing Jobs

Abney Associates Ameriprise Financial Advisor In Melville Ny Ameriprise Financial Financial News Financial

Living Abroad What About My South African Family Trust Family Trust South African South

Trust Vs Restricted Payout As Annuity Beneficiary

Period Certain Annuity What It Is Benefits And Drawbacks

Annuity Beneficiaries Inheriting An Annuity After Death

Annuity Beneficiaries Inherited Annuities Death

Secure Act Retirement Planning Opportunities And Challenges Retirement Planning Lifetime Income Financial Advisors

Abney Associates Ameriprise Financial Advisor In Melville Ny Ameriprise Financial Financial News Financial

How To Avoid Probate People Thinks It S Only For The Rich If You Own Over 25k Cash Then You Must Hav Estate Planning Estate Planning Checklist How To Plan

Annuity Beneficiaries Inheriting An Annuity At Death 2022